Discover comprehensive insights, tools, and strategies for successful whiskey cask investment

Begin your whiskey cask investment journey with these essential steps.

Amount, time horizon (minimum 5 years), and return expectations.

Confirm HMRC-bonded storage, insurance coverage, transparent fees, and exit options.

Leverage calculators and the above charts to model scenarios and make data-driven decisions.

By combining market fundamentals, tax advantages, and natural appreciation, Irish whiskey cask investment offers a compelling alternative asset for investors with appropriate risk tolerance and time horizons.

By combining market fundamentals, tax advantages, and natural appreciation, Irish whiskey cask investment offers a compelling alternative asset for investors with appropriate risk tolerance and time horizons.

Irish whiskey casks are especially compelling due to:

Follow our structured approach to whiskey cask investment.

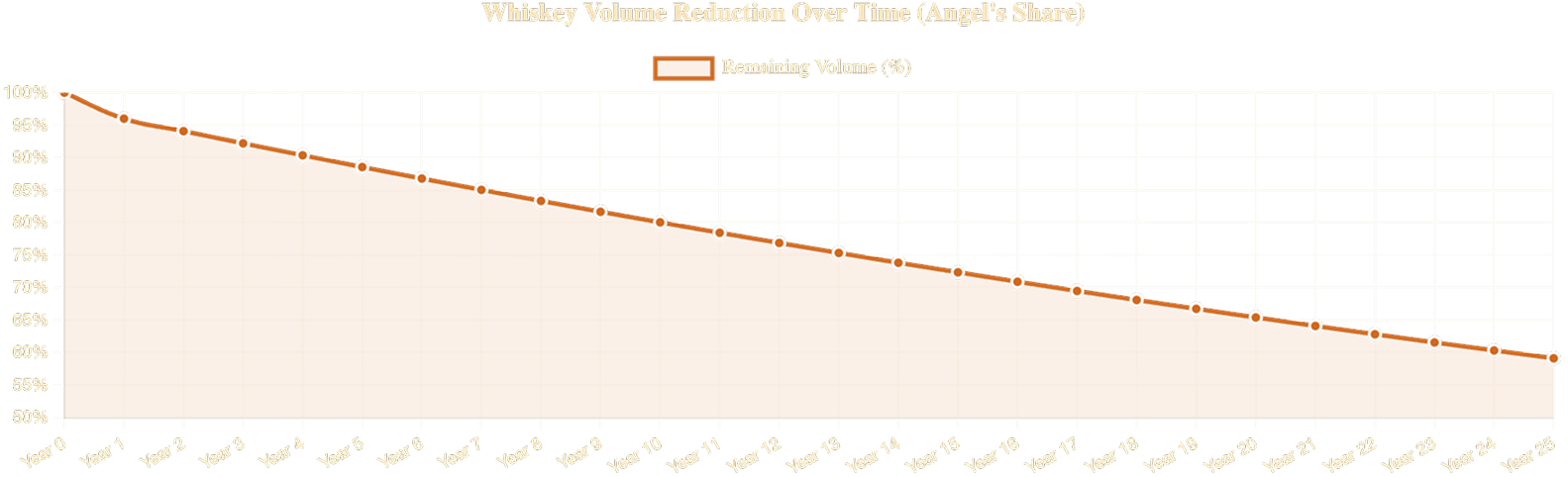

As whiskey matures, a portion evaporates (“Angel’s Share”), concentrating flavors. The first year sees ~4% loss, then ~2% each subsequent year.

Even though storage and insurance may be included initially, understanding additional costs is crucial for accurate ROI modeling.

£375: Storage (5 years × £75)

£625: Insurance (5 years × £125)

£100: Regauging (once)

£200: Purchase Commission (2%)

£360: Sale Commission (2%)

£1,660: Total

A robust Cask Investment Calculator should allow you to input:

Understanding Potential Returns

Example Return Calculation

A £10,000 cask held 5 years, sold at £18,000 incurs £1,660 in costs, yielding £6,340 net profit → 63.4% total return (10.5% p.a.).

Understanding and managing risks is crucial for successful whiskey cask investment.